I am often asked about How I can hold trades for 3 months, the Psychology behind what I do and how I do it.

Some common comments:

How can you hold a trade for so long?

I can´t bring myself to stay in a trade for that amount of time

Why do you hold a trade for that long?

These are difficult questions to answer in that I do not see these times, 30 – 60 days, as a long time.

When I first started trading it was on equities on weekly Time Frames, and I have held several Equities trades for 70 – 85 weeks.

Having said that, 30 – 60 days does not seem a long time.

It took me a reasonable amount of practice to get used to coming down to trading Daily charts from Weekly charts, so for me it was the reverse of the questions I am being asked, and a Psychological adjustment.

Following from that it took a reasonable amount of work and practice to come down from Daily charts to 4 Hourly charts and another Psychological Adjustment in this.

It was at this point of time that I realised that I am not thinking in terms of the number of days, BUT in terms of the number of periods.

If you can hold a trade for 1 day on 1-hour time frame – that is the same number of periods as 4 days on 4 hour time frame and 24 days (1 month) on daily time frames.

This is all about relativity not about absolute amount of time in the trade, it is about getting your head around ¨The number of periods¨ not ¨The amount of Time in the position¨

Let me use a couple of examples to demonstrate:

This is a pair of trades I took in 2015

We have a Falling Resistance Line (FRL) break in Late April, followed by an Ascending Flag Break in May of 2015

Total time in Trade 1 – 56 days. Gain – 3447 pips

Total time in Trade 2 – 46 days. Gain – 2825 pips

A total gain of 6372 pips for an average gain of 113.78 pips per day.

Is there any reason why a trader would not want to hold this position regardless of the amount of time in Trade?

If we bring this back to the number of time periods instead of the amount of time:

56 periods: Daily 56 Days

4 Hourly 9.5 Days

1 Hourly 2.4 Days

30 Mins 1.2 Days

Recent Position:

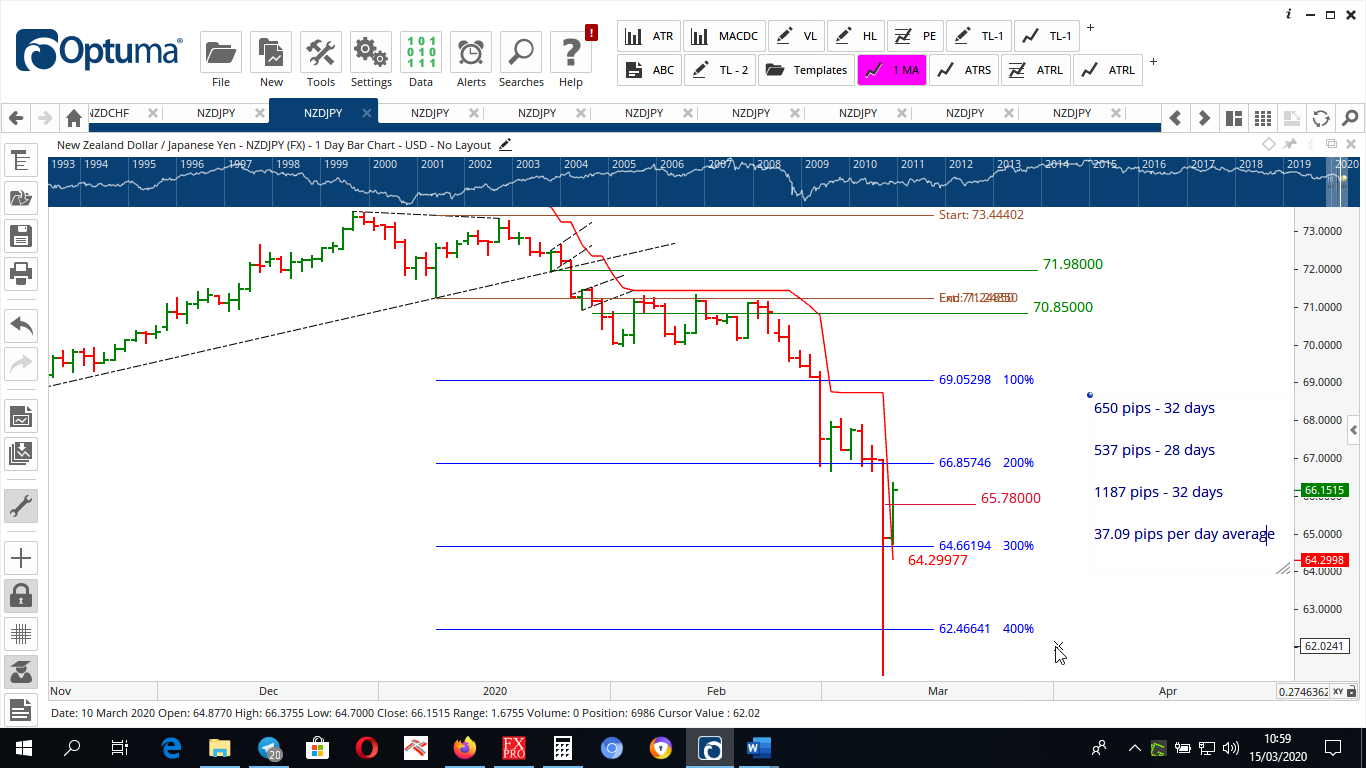

Here we have a pair of trades taken in January 2020

Descending Flag 1 – 27th January 650 pips – 32 days

Descending Flag 2 – 30th January 537 pips – 29 days

There is also a Double Top in effect here along with a Rising Support Line Break, the entry for each of these were at the same levels as the Descending Flag entries, so only 2 trades were taken here.

A total gain of 1187 pips for an average gain of 37.09 pips per day.

Is there any reason why a trader would not want to hold this position regardless of the amount of time in Trade?

If we bring this back to the number of time periods instead of the amount of time:

32 periods: Daily 32 Days

4 Hourly 5.3 Days

1 Hourly 1.3 Days

30 Mins 0.7 Day

Current Position:

Here we have 4 open positions

We have a Falling Resistance Line (FRL) Break 27th February, 100SMA Break 27th February, Double Bottom Neckline Break 28th February, Horizontal Resistance (HRL) Break 11th March

All are open positions at the time of writing,

Total time in Trade 1 – 12 days. Gain – 564 pips

Total time in Trade 2 – 12 days. Gain – 499 pips

Total time in Trade 3 – 11 days. Gain – 406 pips

Total time in Trade 4 – 3 days. Gain – 252 pips

A total gain of 1721 pips for an average gain of 43.42 pips per day.

Is there any reason why a trader would not want to hold this position regardless of the amount of time in Trade?

If we bring this back to the number of time periods instead of the amount of time:

12 periods: Daily 12 Days

4 Hourly 2 Days

1 Hourly 0.5 Days

30 Mins 0.25 Day

For me it is all about ignoring the amount of time and relating everything to the number of periods (Bars / Candles) and I would suggest this same process is what most traders will need to adjust to Psychologically handle the number of days in a position.

Why do I trade Daily and 4 hourly instead of 1 hour or 30-minute charts is a common question also, and the answer is reasonably simple – Lifestyle.

Conclusion

If you can hold a 1 hourly position for ½ day, you can hold a daily position for 12 days.

If you can hold a 4-hourly position for 5 days, you can hold a daily position for 32 days.

If you can hold a 4-hourly position for 9.5 days, you can hold a daily position for 56 days.

If price is heading in the correct direction and not reversing into your open profits (there are pullbacks that are not directional changes), what is the issue with holding a position for 30 – 60 – 90 days if necessary to extract the most profit you can from these positions as they present themselves.

Why would we want to prematurely exit a position that has a strong potential for more profit as the price action progresses?

Holding these positions for these number of periods is a learned skill and requires the ability to read price action – another learned skill.

Trading on longer time frames, I get to have a life because I am not bound to the computer for 12 hours each day. I only need to be available at the end of each period to evaluate open positions for potential Stop Adjustments and analyse for potential new orders.

If I want to meet some friends for a few beers, I can do that late in the day because the longer time frames are less affected by the increased spreads and sometimes increased volatility with decreased volume which can occur at Close of the New York session.

If I have work that needs to be done on the farm during the day, I can schedule that project and break it into pieces which allows me to break away at end of 4hr period to adjust what I need to adjust.

Daily and 4 hourly charts allow ne to have a lifestyle along with my trading, allows me to pursue outside interests without real restrictions on my time.

I trust this has been of assistance and welcome any questions. I also invite anyone to work and test with longer time frames as they can be very profitable and the longer time frames are not affected as much as shorter time frames by news announcements.

This is a great article, especially for beginners like me. Gives an idea of how to go about trading periods. Do you mind writing about sessions and their possible effects, please.

Hi Abby, that you for your feedback.

My experience is that the longer the time frame, the news fluctuations are less of an issue

Preciouse lesson for begginner and even advanced trader

Hi Hassan, I am happy the article was useful for you

when holdinge z a trade for long time like 2 to 3 months what should be the ithe sudeal lot size and the leverage to keep the moving

HI Joe,

The lot size has nothing to do with the amount of time the trade is open, that has to do with Risk Management.

A common misconception is exactly what Leverage is – Leverage doesn’t magnify your profit or loss, it merely affects how much margin you have to put up to open the position.

I use the same risk management parameters for lot size regardless of the amount of time I perceive the trade lasting because you don’t know how long it will last – 2 bars or 3 months